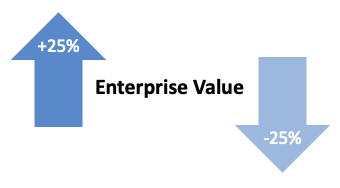

The market for privately held companies is very price inefficient. Typically, bona fide offers from well qualified buyers will range plus and minus twenty-five percent (+/- 25%), above and below, a nominal enterprise value. So there is great value-added from artfully packaging and properly marketing a business for sale.

Price Inefficiency

Maximize Price & Optimize Terms

In addition to maximizing sales price with multiple offers, by way aggressively marketing your business, we also optimize the terms of your transaction including:

- Amount and timing of payments

- Allocation of business risks going forwards

- Transition role and duration for the seller

- Increasing positive and decreasing adverse effects on the workforce

Sellers often wonder when is the best time to sell their business. Answering this question involves industry, company, and personal considerations. For more information on these important considerations, see this article in our Insights section: The Best Time to Sell a Company

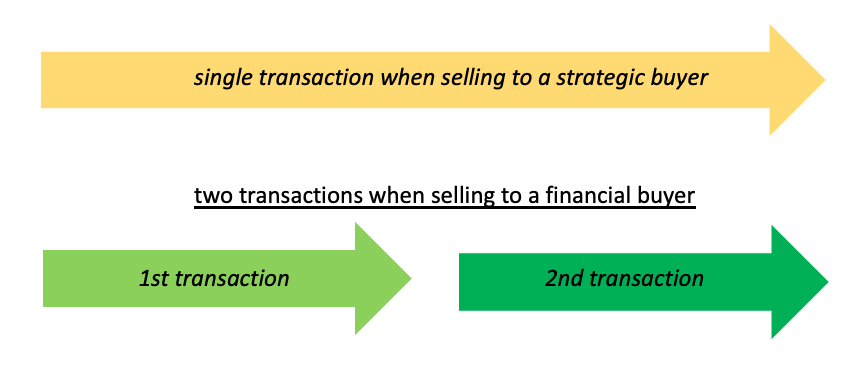

Strategic buyers and financial buyers are very different. Selling to a strategic buyer involves a single transaction, whereas selling to a financial buyer commits you to two transactions – one now, and another in a few more years when the financial investors wants to exit too. So, the way financial and strategic buyers evaluate acquisitions and the way they make money are very different, really opposite in many ways, see Financial and Strategic Buyers are very Different.

Strategic buyers can pay more than financial buyers since they benefit from operating, marketing, and other synergies. For more information, see our insights on How Much Will a Strategic Buyer Pay

Sale Process Overview

We work with company management to:

- gather data

- build projection models

- build presentation materials

- develop a list of buyers

- develop a marketing strategy

- initiate pre-marketing activities

After the preparation and pre-marketing phase, we:

- Begin contacting potential buyers and start to actively market your company

- Negotiate confidentiality agreements to protect the company’s identity

- Transmit the confidential information memorandum to interested and qualified buyers

- Address the early Q&A

- Coordinate the formal submission of buyer indications of interest

- Facilitate due diligence

- Coordinate management presentations for qualified bidders

- Send seller definitive draft documents

- Receive final offers with definitive documents marked-up

- Negotiate definitive documents and select the leading buyer

- Coordinate any required final due diligence

- Negotiate final deal points and manage unforseen points

- Attorneys lead the final documentation and closing

- Impact Capital Group provides negotiation and coordination support through closing

Driving Premium Value

- Create a unique and compelling story for every client

- Potential buyers or investors list is pre-approved by management

- Follow a disciplined approach with specific deliverables for each stage

- Cast a wide and discreet net for all likely buyers or investors

- Strategically prioritize which buyers or investors to approach early vs. later

- Rehearse and continuously improve the presentation

- Plan engaging management meetings with buyers or investors

- Keep all backup buyers and investors engaged until the transaction closes

- Remain quick, discreet, and transparent throughout the entire process