Company buyers find value in a proactive search process to build or expand their pipeline of synergistic acquisition candidates. Candidates that are not active in the sell-side market are especially valuable to identify and contact.

Typical buy-side client engagements include a Private Equity firm seeking add-ons for a portfolio company, a Corporate buyer seeking to expand into a new technology or product area, or to expand their current product offerings, or a financial buyer seeking to acquire a number of related businesses in a targeted sector.

Often, we win the trust of sellers by providing them with objective information, such fair value and as market conditions, so they can be comfortable engaging in a proprietary sale transaction with our client.

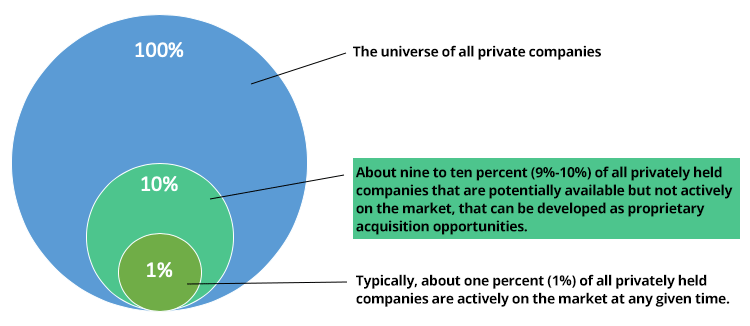

The statistics on acquisition candidates:

Typically, about one percent (1%) of all privately held companies are actively on the market at any given time. However, there are many more businesses, about nine to ten percent (9%-10%) of all privately held companies that are potentially available but not actively on the market, that can be developed as proprietary acquisition opportunities using a proactive buy-side search.

Proactive buyer driven searches begin with criteria development to reflect the strategic intent and synergies desired by our client. Impact Capital Group then does the heavy lifting to identify that 9-10% of relevant candidates, contact those business owners, assess their availability, introduce our client, facilitate confidential information exchanges, and promulgate transactions.

Buy-Side Process

- Define objectives

- Gather data

- Build projection model

- Develop marketing strategy

- Develop presentation materials

- Compile list of investors

- Initiate pre-marketing

- Review and approval of presentation materials and investor list

- Contact potential investors

- Negotiate confidentiality agreements

- Send confidential information memoranda

- Communicate with investors

- Send process letters

- Solicit indications of interest

- Facilitate due diligence

- Coordinate management presentations for qualified bidders

- Send draft definitive documents

- Receive final offers with definitive documents mark-ups

- Negotiate definitive documents

- Select investor(s)

- Coordinate final due diligence

- Negotiate final deal points and manage unforeseen points

- Attorneys take the lead in final documentation and closing

- Impact provides negotiation and support throughout closing