You have spent years building a successful company. The company is now profitable and still growing.

How do you know the “best” timeframe to sell the business?

The “best” time to pursue a transaction: Two factors

- Personal considerations and the stage of the company are the most important factors.

- External issues such as the industry,competitive dynamics, the market,and tax cycles are secondary factors.

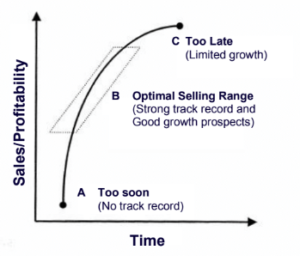

Initial phase of company: Too soon

Companies tend to go through a normal maturation process. In the early years, the product or service is being refined, resources are invested into people, equipment, and marketing, the customer base is forming, production capacity is being established, and cash flow, sales and profits are volatile and uneven.

- During this hyper-growth phase, value is still building and the lack of a financial track record complicates realizing full value for the company.

Mid-life phase of company: Optimal time to sell

Successful companies typically enter a mid-life phase of regular growth, effective operations, and productivity gains. During this phase, the financial results become more regular and predictable. From a company perspective, the optimum time to sell a business is during this mid-life growth phase, as shown in Figure 1.

This mid-life growth phase is the optimum time to sell a business because the seller can realize a full value for the business reflecting the expected future growth of the company. If properly marketed, the business valuation will reflect a discounted cash flow valuation analysis based upon a defensible 5-year forecast.

- Ineffective marketing will result in a lower valuation based on the current or past financial results of the company.

- This mid-life predictable growth phase can last many years, and even decades, before the inevitable maturation of the company.

Late phase of company: Too late

As the company approaches maturity, demand for its product or service is stabilizing, competition is increasing, the entrepreneurial drive to develop new products or services may have waned, and growth is slowing.

Unfortunately, selling late in the corporate life cycle deprives the seller of value from the expected future growth of the business.

- Personal considerations such as health, wealth, and lifestyle also affect the best time for an owner to sell a business.

- Since it may take years to effect a smooth transition, it is important for the owner to begin the sale process while in good health and well in advance of the company’s maturation.

The benefits of wealth diversification cannot be overstated, since successful entrepreneurs typically have 80% or more of their net worth tied up in an illiquid single security that is also usually dependent upon their personal involvement in the business.

Liquidating such a position provides both wealth diversification and lifestyle options.

Objectively assessing the stage of your company and your personal objectives will help you determine the “best” time to sell your business.

Michael Cohen has represented world class entrepreneurs and has advised such companies as Johnson & Johnson, Hewlett Packard, and General Electric on strategic M&A and has closed over 40 optimized corporate equity transactions for buyers and sellers.

Michael Cohen has represented world class entrepreneurs and has advised such companies as Johnson & Johnson, Hewlett Packard, and General Electric on strategic M&A and has closed over 40 optimized corporate equity transactions for buyers and sellers.